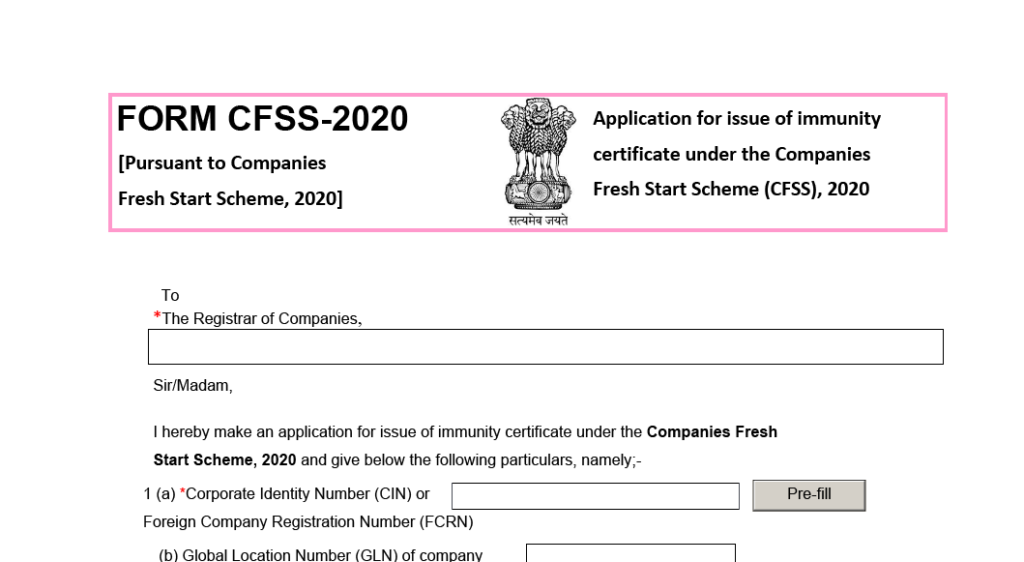

“Companies Fresh Start Scheme” a scheme launched by The Ministry of Corporate Affairs to give a fresh start to defaulting companies in March 2020. But there was one condition to get the benefits from the prosecution to such companies by filing E form CFSS 2020.

Important dates of CFSS form:

CFSS Form introduced by the Ministry of Corporate Affairs on January 16, 2021, and June 30, 2021, is the last date for filing form.

Why fill this form

A company will have the immunity for belated documents filed under the Scheme eform CFSS-2020 after the closure of the scheme and after the documents are taken on the file, or on record or approved by the Designated authority

Applicability

All those Forms filed after the due date but between March 30, 2020, to December 31, 2020.

Here are some important terms meaning used in the CFSS Scheme

Defaulting Company

Defaulting Company are defined under The Companies Act, 2013, and which has made a default in filing of any of the documents, returns including annual statement on the MCA – 21 registry.

Designated Authority

Designated authorities are the registrar of companies having jurisdiction over the registered office of the company.

Inactive Company

Inactive Company is those which is not carrying on any business or operation or has not made any significant accounting transaction during the last two financial years or the company who has not filed its financial statements and annual returns for the last two financial years.

Which forms are not covered under this scheme?

- Registrars of the company (ROC) E-form SH-7 which is related to an Increase in the Authorized Capital.

- Registrars of the company (ROC) E-from CHG-1 which is related to Application for registration of creation or modification [other than those related to debentures] of charges.

- Registrars of the company (ROC) E-from CHG-4 which is related to Particulars of satisfaction of charges.

- Registrars of the company (ROC) E-from CHG-8 which is related to Application to Central Government for extension of time for filing particulars of registration of creation/ modification/ satisfaction of charge OR for rectification of omission or misstatement of any particular in respect of creation/ modification/ satisfaction of charge.

- Registrars of the company (ROC) E-from CHG-9 which is related to Application for registration of creation or modification of charge for debentures or rectification of particulars filed in respect of creation or modification of charge for debentures.

Special Provision for Inactive Companies under the Scheme given and fresh start scheme also provides a major benefit to defaulter inactive companies. Defaulting inactive company can along with the filing documents under this scheme.

Can also apply for any of the following two options as per their choice:

- If the company wants to declare itself as Dormant Company under section 455 of the Act. The company can take advantage by filing the Form MSC-1 electronically by paying a nominal as prescribed for this form.

- Company can strike off their name from the register of companies. The company can take advantage by electronically filing Form STK-2 along with a deposit of nominal fees prescribed for this form.

Non-Applicability of CFSS, 2020 in the following cases:

- All the companies covered under section 248 of the companies act, 2013 who have received the final notice from the ROC for striking off.

- All companies who have sent the application to ROC for striking off their registered name.

- Companies amalgamated under the scheme of compromise & arrangement;

- Before the scheme was introduced the companies who have applied for dormant status under section 455 of the companies act, 2013.

- Vanishing Companies

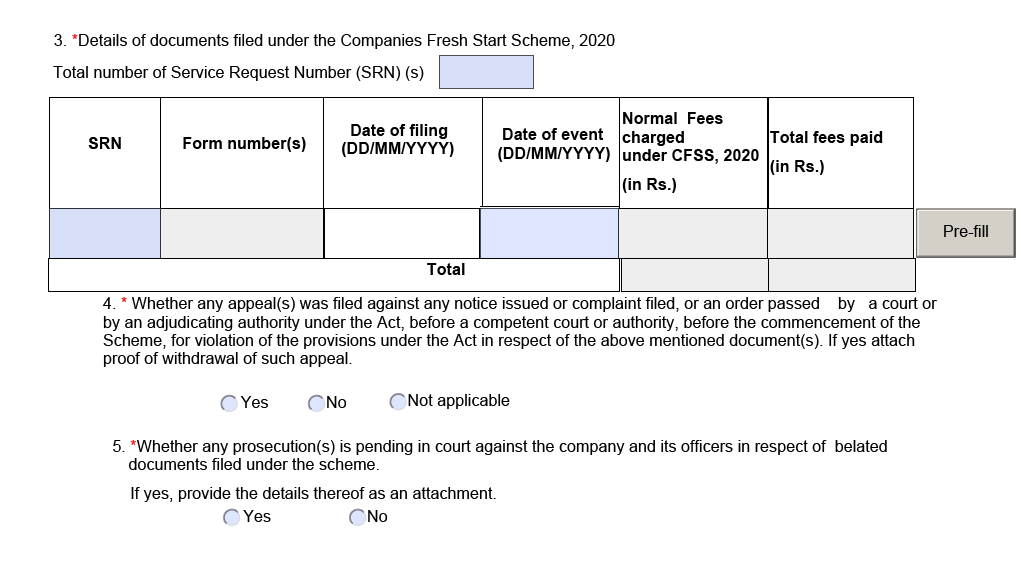

This application are often filed by the entity after closure of the scheme and after the documents that immunity is being asked are filed by the entity or taken on record or approved by the designated authority because the case could also be. It may be noted that under any circumstances, the appliance for seeking immunity can’t be filed after the expiry of 6 months from the closure of the scheme

After the Form- CFSS 2020 has been filed by the entity online, an immunity certificate shall be issued by the designated authority under this scheme after the authority is satisfied with the claim and declaration made within the Form: CFSS-2020.

cfss form meaning, meaning of cfss, what is the meaning of deped, cfss meaning, cfss form due date , cfss form help kit, cfss form download, cfss form faq, cfss form for llp, e form cfss-2020, cfss scheme, form cfss-2020 applicability, cfss scheme, 2020 applicability