Everything About GST

What is GST Means ?

GST means Goods and Services Tax. It is an indirect tax that has replaced many indirect taxes in India such as excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in Parliament on 29th March 2017 and came into effect on 1st July 2017.

Goods and Service Tax (GST) is levied on the supply of goods and services. It is the destination-based consumption tax. Gst is not a single indirect tax. As state vat and excise on are there on few products, which were not under the purview of GST.

- Alcohol for human consumption: On alcohol, the power to tax remains with the states.

- Petroleum products: GST was not imposed on five petroleum products — crude oil, diesel, petrol, natural gas and ATF.

- Tobacco: Along with GST, the Central Government has the power to levy additional excise duty on tobacco products.

How GST Work ?

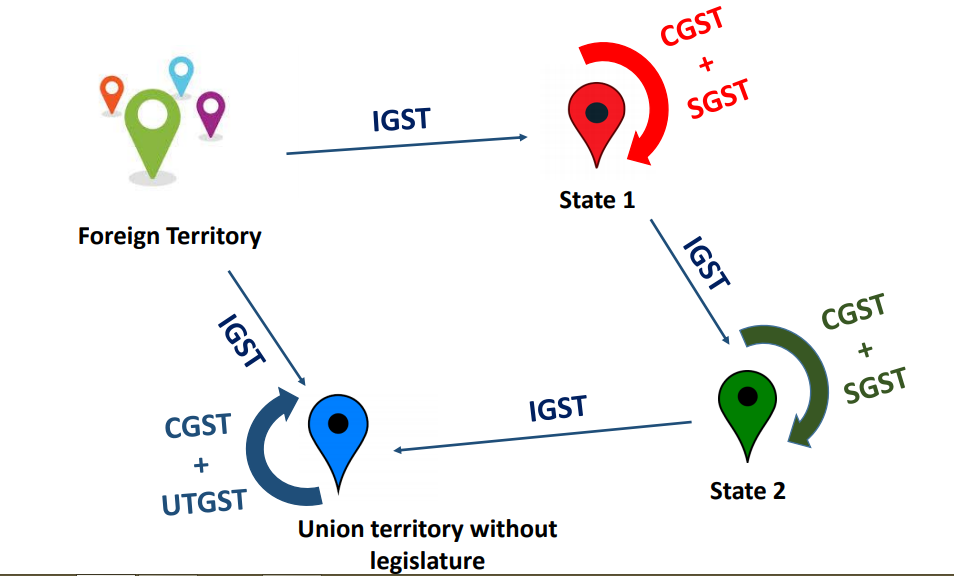

There are 4 types of GST each have its own significance. Let understand each individually.

- SGST (State Goods and Services Tax)

- CGST (Central Goods and Services Tax)

- IGST (Integrated Goods and Services Tax)

- UGST (Union Territory Goods and Services Tax)

SGST (State Goods and Services Tax)

Under GST, SGST is levied by the state government on intra-state goods and service transactions. The revenue collected through State Goods and Service Tax is earned by the state government where the transaction is made.

In the case of a union territory like Andaman and Nicobar Islands or Chandigarh, SGST is replaced by UGST or Union Territory Goods and Service Tax.

CGST (Central Goods and Services Tax)

In the case of SGST, It is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST Act. As explained above, CGST will also be levied on the same Intra State supply but will be governed by the Central Government.

IGST (Integrated Goods and Services Tax)

Integrated Goods and Service Tax is the tax levied on inter-state goods and service transactions. It is applicable to imports and exports as well. Under IGST, the taxes charged are shared by both the center and state. The SGST part of the tax goes to the state wherein the goods and services are consumed.

What is GST Registration?

GST Registration is a process in which a taxpayer gets himself registered under GST. After the registration of a business, a unique registration number is assigned to them known as the Goods and Services Tax Identification Number (GSTIN). This is a 15-digit number assigned by the central government when the taxpayers obtain registration.

When GST Number is required ?

GST number is of Four types and if anyone comes under these categories then a GST number is required.

- Normal Taxpayers

- Casual Taxable Individual

- Non-Resident Taxpayer Individual

- Composition Taxpayer

Normal taxpayers

Most businesses in India come under this category.

Whose Businesses turnover exceeds Rs 40 lakh for the goods sector and 20 lakh for the services sector in a financial year are required to register as normal taxable persons. However, the threshold limit is Rs 10 lakh if a business in the northeastern states, J&K, Himachal Pradesh, and Uttarakhand.

Casual taxable individual

Occasional or seasonal businesses are required to register their businesses under GST for this category. Businesses have to make a deposit equal to the GST liability from the occasional or seasonal operations.

Registration tenure is of 3 months. However, businesses can apply for renewal and extensions.

Non-resident taxable individual

Individuals who live outside India but occasionally supply goods or services as agents, principals, or in other capacities to Indian residents are liable to file for registration under this category.

The business owner has to pay a deposit equal to the expected GST liability during the GST active tenure. The normal tenure is 3 months. However, individuals can extend or renew the registration if required.

Composition registration

Businesses whose annual turnover of up to Rs 1 crore are eligible for registration under the composition scheme. Under this scheme, businesses have to pay a fixed amount of GST irrespective of their actual turnover.

The major offenses under GST are:

There are 21 offenses under the GST.

- The major offenses under GST are:

- Submission of fake financial records/documents or files, or fake returns to evade tax

- Obtaining refunds by fraud

- Deliberate suppression of sales to evade tax

- Opting for a composition scheme even though a taxpayer is ineligible

- Not registering under GST, even though required by law.

- Supply of any goods/services without any invoice or issuing a false invoice

- The issue of invoices by a taxable person using the GSTIN of another bonafide taxpayer

- Submission of false information while registering under GST

Penalty for Charging GST when not registered

Not paying tax or making short payments have to pay a penalty of 10% of the tax amount due subject to a minimum of Rs. 10,000.

In case tax has not been paid or a short payment is made, a minimum penalty of Rs 10,000 has to be paid. The maximum penalty is 10% of the tax unpaid.