dir 3 kyc documents required,penalty for dir 3 kyc,fees for dir 3 kycdir-3 KYC due date,dir -3 kyc due date for 2021,dir -3 kyc due date for 2020,dir 3 kyc,dir 3 kyc web,dir 3 kyc form,dir 3 kyc,dir 3 kyc form,dir 3 kyc to be filed every year,what is dir 3 kyc,dir 3 kyc fees,dir 3 kyc web based,dir 3 kyc web due date,dir 3 kyc penalty,dir 3 kyc extension,dir 3 kyc applicability,how to check dir 3 kyc status

Meaning of DIR-3 KYC

Director Identification Number (DIN) is a unique number given to an individual who wants to be a director or an existing director of a corporation.

To get a DIN number application form for DIR-3 is very important. This used to be a one-time process for someone who wanted to be a director in one or more companies.

As the Ministry of Corporate Affairs (MCA) has updated its registry, all directors with a DIN will need to submit their KYC details annually in eForm DIR-3 KYC. This procedure is mandatory for the disqualified directors too.

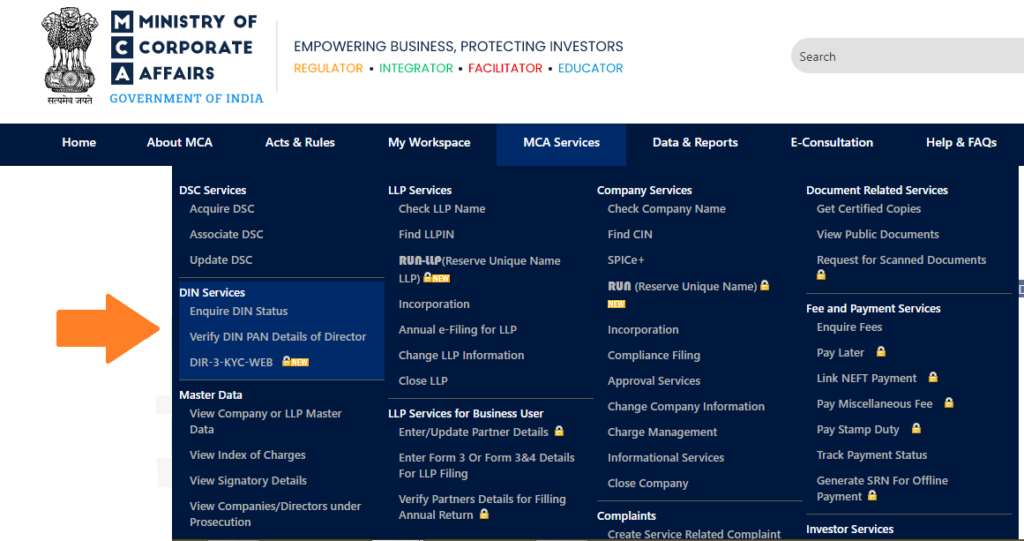

DIR -3 KYC Web Services

Any DIN holder who has already submitted eForm DIR-3 KYC in any of the previous financial years and who does not require an update in any of his KYC details as submitted may perform his annual KYC by accessing the DIR-3 KYC web service. No fee is payable up to the due date of each financial year. Rs.5000 will be charged after due date.

Keypoints Before Filing the eForm DIR-3 KYC

- As per PAN – Name, Father’s Name, Date of Birth (DoB), PAN Number (mandatory for citizens of India), Personal Mobile Number, and Personal Email Address and Permanent/ Present address.

- Aadhaar is mandatory if it is assigned. If not, then a Voter ID or Passport, or Driving License shall be attached. Accordingly, a copy of any one of the above-selected information is to be attached.

- The director has to use his own digital signature while filing this form.

- Correct information in eForm should be certified by a practicing Chartered Accountant or Company Secretary, or Cost and Management Accountant.

,dir 3 kyc requirements,dir 3 kyc circular,is dir 3 kyc to be filed every year,how to fill dir 3 KYC,how to file dir 3 kyc form,

DIN Deactivated for Non-filing of DIR-3 KYC

If the director does not file an e-Form by 30th September on the MCA 21 portal, the DIN of the director will be marked as Deactivated of DIR-3 KYC. Reactivation charges of eForm DIR-3 KY will be 5000.

Charges for the DIR-3 KYC

If e-form is filed within the due date (30 September) of the respective financial year, no fee is payable. But, if filed after the respective dates, for the next 2-3 weeks as per government notice fine will be a fee of Rs.500(Rupees Five Hundred Only). After that notice, the fine will be ten times Rs.5000(Rupees Five Thousand Only).

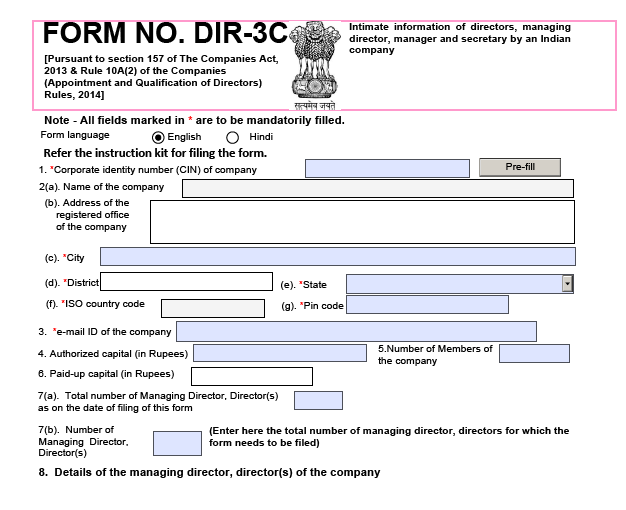

How to file your DIR – 3 KYC

Download the form from the MCA website.

Give DIN details

Fill in the details very carefully

Attachment to be made

- Proof of Permanent address.

- Conditional attachments.

- Copy of Aadhaar Card.

- Copy of Passport.

- Proof of present address.

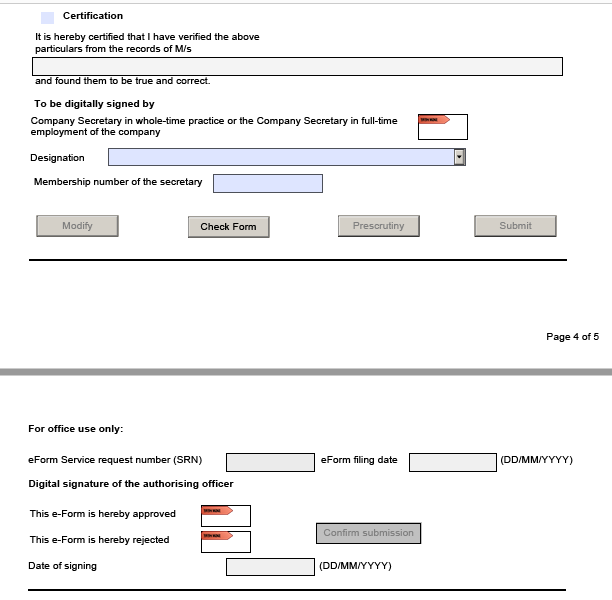

E- form Certification

Digitally signed by a practicing Chartered Accountant/Cost Accountant, or a Company Secretary. It is very important to enter the details of the practicing professional and then attach their digital signature.

Comman Mistake to Aviod

- Valid and authenticate the document.

- Father’s name proof not submitted by an applicant.

- Date of birth proof not submitted by an applicant.

- Residential address proof not submitted by the applicant.

- A copy of the passport (for foreign nationals) is not submitted.

DIN holder and a professional

- The DIN holder and a professional (CA/CS/CMA) are the two people certifying the form with their signatures on form DIR-3 KYC.

Citizens of India PAN mentioned in the Digital Signature Certificate (DSC) is verified with the PAN mentioned in the form. - In case of foreign nationals, the name in the DSC affixed should match with the name entered in the form. DSCs affixed on the form should be duly registered on the MCA portal.

After form submission

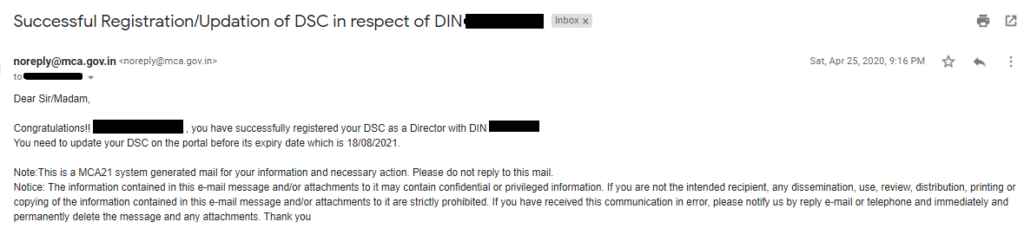

Service Request Number (SRN) generated for future use.

KYC confirmation by mail.

We will be able to deliver your cargo from China, Korea and Japan in the shortest possible time

We deliver all types of goods and vehicles from China, Korea and Japan to Europe, Russia and Kazakhstan

Japanese cars