income tax changes india, income tax policy changes, income tax changes for 2020, what are the tax changes for 2020, income tax slab changes in budget 2020, income tax changes uk, income tax law changes 2020, income tax bracket changes, what are the income tax changes for 2020, income tax code changes, how will income tax changes affect me,what are the new income tax ruleswhat are the new income tax changes, income tax changes in new budget, income tax new changes, income tax changes 2021, income tax changes, budget 2021 income tax changes, how to change income tax password, income tax changes in budget 2022, income tax slab changes, recent changes in income tax, changes in income tax in budget 2020

The Central Board of Direct Taxes (CBDT) has notified Income Tax Return (ITR) Forms for the Assessment Year 2021-22.

Nearly 30 changes have been made in the income tax act 1961 which is now the Finance Act. But there are Most important key changes which you should know and these changes are :-

1. Changes in the ITR

The new ITR forms which are very have been changed in context to the amendments made by the Finance Act, 2020. The ITR-1 shall not be available to a taxpayer in whose case the tax has been deducted on cash withdrawal under Section 194N.

2. Change in taxability of dividend Income

Recipient shareholders instead of payment of dividend distribution tax (DDT) on declaration, distribution, or payment of dividend by the domestic company. Thus, no DDT shall be payable by the company or mutual fund on any dividend distributed on or after 01-04-2020 and the recipient shall be liable to pay tax on such dividend income.

income tax changes, income tax changes in budget 2020, income tax changes 2020, income tax changes in budget 2021, income tax changes in budget,income tax policy changes announced by cbdt, income tax rate changes, income tax changes from april 2021, income tax changes india, income tax policy changes, income tax changes for 2020, what are the tax changes for 2020, income tax slab changes in budget 2020, income tax changes uk, income tax law changes 2020, income tax bracket changes, what are the income tax changes for 2020, income tax code changes, how will income tax changes affect me,what are the new income tax ruleswhat are the new income tax changes, income tax changes in new budget, income tax new changes, income tax changes 2021

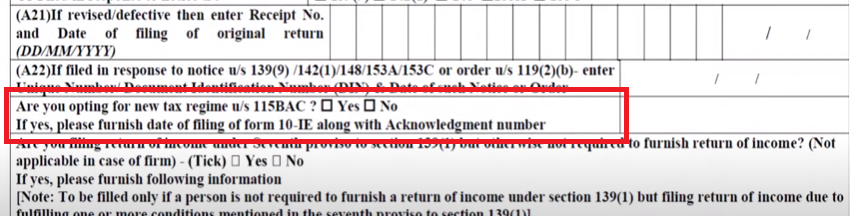

3. An option has been given to Individual or HUF as per Section 115BAC

As you know from A.Y 2021-22 option is available to Individual & HUF whether to opt New Scheme or not .

So an option is given to Assessees to select new scheme-Section 115BAC and required to file Form-10IE before filing the return u/s 139(1).

4.TDS/TCS to be deducted/collected at original (higher) rate on Non-Salary Payments

The taxpayer needs to deduct TDS/collect TCS at original rates (i.e. without considering concession of 25% rate).

5. Carry forward TDS no longer a Option

Credit for tax deducted at source shall be given in the assessment year in which such income is assessable as per Section 199 of Rule 37BA. However, where such income is assessable over a number of years, credit for tax deducted at source shall be allowed across those years in the same proportion in which the income is assessable to tax.

6. No ITR filing for Senior Citizen aged 75 years or more

Senior‐citizen of India who aged 75 years or more, earning only pension income (may have interest income from the bank in which pension is received) would be exempt from filing ITR.

7.Marginal relief to be highlighted in the ITR

Marginal relief is allowed when taxable income is beyond the threshold limit after which surcharge is payable. Earlier no separate effect of marginal relief was required to be shown in the ITR while computing the total tax of the assessee.

8.The Time limit reduction for filing ITR

Due to covid, the last date for filing the revised/belated return has been extended from 31st December 2021 to 31st January 2022. However, the original was 31 Dec 2021.

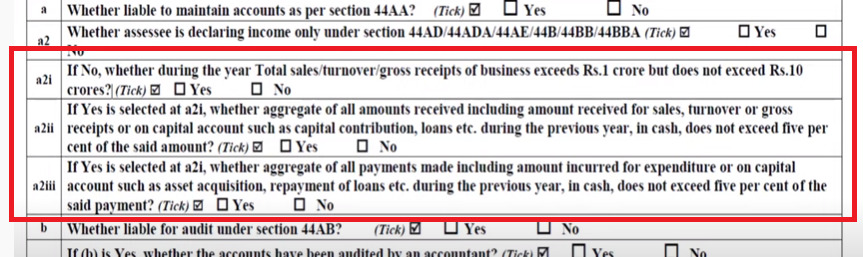

9.Increase in threshold limit for tax audit

Increased from Rs 1 crore to 10 crores if the following conditions are satisfied-

- His aggregate of all receipts in cash during the previous year does not exceed 5 % of such receipts.

- His aggregate of all payments in cash during the previous year does not exceed 5 % of such payments

10.Notice of Scrutiny Assessment With 3 Month of FY

In the year in which return is furnished. notice u/s 143(2) of the Act for selection of ITR for scrutiny assessment will be issued within three months from the end of that financial year.

11.New Section 80M

Deduction allowed for a domestic company for the amount received as dividend from another domestic company, a foreign company, or a business trust. The deduction is allowed when the company further distributes the dividend to the shareholders.

12.Deletion of Schedule Detail of Investments (DI)

Deduction for the investments/deposits was available for the particular Assessment Year 2020-2021 inserted a new Schedule DI (Detail of Investments/deposit/payment for the purpose of claiming deduction).

The benefit of an extension was available for Assessment Year 2020-2021 only, now it has been removed from the Schedule DI.

13.Unit-Linked Insurance Plan with high premium

Unit-Linked Insurance Plan (ULIP) issued after 1st Feb 2021 with high premium will be eligible for a tax rate of 10% on long term capital gains u/s 112A of the Act only if minimum equity component (90% or 65%) is maintained throughout the term of such insurance policy.

14.Tax audit Exceptions

If the company is able to full fill the form conditions then there will be no need for the tax audit

Company turnover is more than 1 crore but less than 10 crores and the given form conditions :-

income tax changes, income tax changes in budget 2020, income tax changes 2020, income tax changes in budget 2021, income tax changes in budget,income tax policy changes announced by cbdt, income tax rate changes, income tax changes from april 2021, income tax changes india, income tax policy changes, income tax changes for 2020, what are the tax changes for 2020, income tax slab changes in budget 2020, income tax changes uk, income tax law changes 2020, income tax bracket changes, what are the income tax changes for 2020, income tax code changes, how will income tax changes affect me,what are the new income tax ruleswhat are the new income tax changes, income tax changes in new budget, income tax new changes, income tax changes 2021