Meaning of OPC and Pvt Ltd Co.

One person company means one individual who could also be a resident or NRI can incorporate his/her business but must satisfy all the guidelines provided in the Companies Act, 2013. When all the conditions will be defined than a person can take the benefits of a sole proprietorship.

Private Ltd. is preferred sort of corporate legal entity in India. All the rules and requirement for registration of a private limited company is governed by the Companies Act, 2013 and the Companies Incorporation Rules, 2014. To make the official identity a minimum of two shareholders and two directors are required.

Rules and Requirment for conversion of One Person Company into Private Limited Company

- Section 17 of the Companies Act, 2013 describr about the rules about the coversion of OPC to private limited company.

- Rule 7(4) of Companies (Incorporation) Rules, 2014.

OPC conversion to Private company, OPC is required to have 2 directors and 2 members.

Two Types of Conversion

- Voluntary Conversion

- Mandatory Conversion

Voluntary Conversion

- In Voluntary conversion unless two years is expired from the date of incorporation of the OPC the conversion to private limited company not possible. But there is one way which say that if the paid-up share capital exceeds rupees 50 lakhs or if its average turnovers exceed INR 2 crores then within two months, the One person company could convert into a private limited company.

- Form INC 5 has to be filed within sixty days by OPC to communicate voluntary conversion to a registrar of companies in board meeting.

- For converting to a private limited company, OPC is required to have 2 directors and 2 members.

Procedure for Voluntary Conversion:-

Notice

As per the section 173(3) of the Companies Act, 2013 and SS-I for convening a meeting of the Board of Directors.

Point of Discussion

- To discuss the conversion of OPC into a Private Limited Company with directors of the Company.

- Board Resolution must be passed for an Increase in the Number of Directors (Minimum 2 Directors).

- Board resolution must be passed to get approval of Directors for increase shareholder of the Company (Minimum 2 Shareholders).

- Resolution has to be passed to get shareholders’ approval for change in MOA (Memorandum of Association) & AOA (Article of Association) of Company.

ROC Form Filling

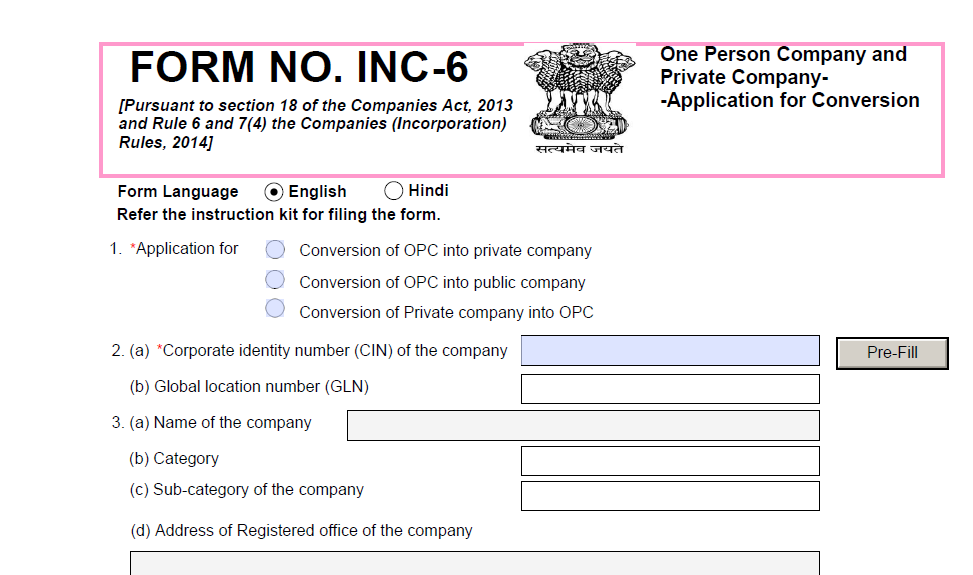

E-Form INC-6

Attachments :-

- OPC must give notice in the Board resolution for a certified copy of that document.

- Copy of the latest financial statements.

- Certificate from a Chartered Accountant in practice for calculation of average annual turnover during the relevant period is mandatory to attach.

Mandatory Conversion

- In Mandatory or Compulsory conversion of OPC, a company must satisfy the following conditions.

- If OPC has paid-up share capital that exceeds Rs. 50 lakhs and the annual turnover of the three consecutive financial years is more than 2 Crores rupees, then conversion is mandatory for everyone.

- If the above condition are satisfied than within 6 months of the date the paid-up share capital exceeded 50 lakhs rupees or the last date of the related period in which the average annual turnover exceeds 2 Crore rupees convert into a private or public limited company.

- Special resolution has to be passed in the General Meeting for the conversion in to private limited company.

- Creditors must verify as there sign of no objection certificate in writing, and by the other members before the resolution is passed.

Procedure for Mandatory Conversion:-

Board Meeting

NOTICE

- According to section 173(3) of the Companies Act, 2013 Issue Notice must be passed for the meeting of the Board of Directors.

Point of Discussion

- To discuss with the promoter and directors that there is a need for the mandatory conversion of OPC into the Company.

- To discuss and pass Board Resolution for an increase in No. of Directors. (Minimum 2 Directors)

- Mandatory approval of Directors for increase shareholder of the Company. (Minimum 2 Shareholders).

- Resolution have to be passed to get shareholders approval for Alteration in MOA & AOA of Company.

ROC Form Filling

E-Form INC-6

Attachments :-

- A person has a giving notice in the Board resolution of a certified copy of that document.

- Copy of the latest financial statements.

- Certificate from a Chartered Accountant in practice for calculation of average annual turnover during the relevant period is mandatory to attach.

E-Form INC-6 (Application for conversion)

Attachments :-

- A Person has a giving notice in the Board resolution of a certified copy of that document.

- A Certified copy of Memorandum of Association (MoA), and Articles of Association (AoA).

- Copy of the latest financial statements.

- Special resolution Certified true copy after person given notice has been authorized.